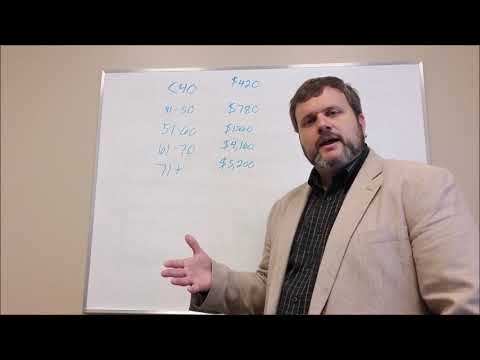

In this video, I'm going to talk about the taxation of long-term care insurance. I work with individuals and business owners across the USA and provide long-term care insurance digitally. So, I'm going to discuss both individuals and business owners of various setups. First, I want to discuss individuals and their long-term care insurance premiums. Here are the deductible amounts based on your age for your tax return. If you're under 40, the deductible amount is $4,420. For ages 41 to 57, it's $8,080. Ages 51 to 61 have a deductible amount of $15,660. Ages 61 to 74 have a deductible amount of $16,060. And for individuals over the age of 71, the deductible amount is $5,200. However, if you are an individual without a business, it's unlikely that you will benefit from this deduction. The new standard deduction has increased, making it harder to itemize deductions. Additionally, you need to have a significant amount of medical expenses, which must be higher than 7.5% of your Adjusted Gross Income (AGI), in order to benefit from this deduction. For individuals, it's probably unlikely that you will be able to take advantage of this deduction, unless you have considerable itemized deductions, such as $20,000, $30,000, or $40,000. Even then, you will still be subject to the overall 7.5% of AGI rule. This means that if all your medical expenses don't exceed 7.5% of your AGI, they won't be deductible. For example, let's say your AGI is $40,000, and 7.5% of that is approximately $3,500. If you have $5,000 in medical expenses for the year and your total deductions are over $20,000, then you may be eligible for a deduction. However, as an individual, the chances of benefiting from this deduction are low. Only when you reach your 60s or 70s and have significant medical bills, you...

Award-winning PDF software

Are long term care benefits taxable 2019-2025 Form: What You Should Know

Dec 18, 2025 — A partnership is required to meet the 100 percent tax on income of partners with capital gain realized from partnerships if the partnership has a partner for more than two years during the taxable year. Form 8949 (Form 949) (March 2018) A partnership is required to meet the 100 percent tax on income of partners with capital gain realized from partnerships if the partnership has a partner for more than five years during the taxable year. Form 1026 (Form 1036) (December 2018) A partnership is required to meet the 100 percent tax on income of partners with capital gain realized from partnerships if the partnership has a partner for more than two years during the taxable year. Forms 8949 (949 & 949-EZ), 1026, 1168, 1157, 1156, 1156-EZ, 1202, 1202-EZ, 1202-EZ-PF, 1203, 1234, 1235-EZ, 1235-EZ-PF and 1321 are required to be filed by April 4, 2019.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-LTC, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-LTC online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-LTC by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-LTC from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Are long term care benefits taxable 2019-2025