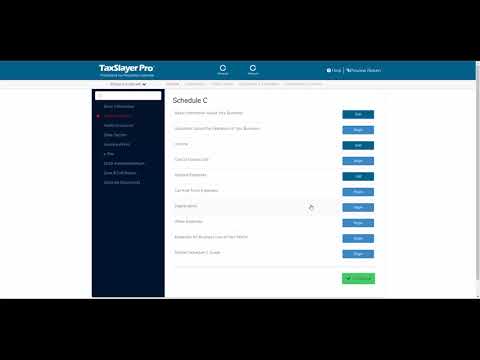

In this tax layer Pro web training video, we're going to cover a more specific topic in the Pro web application - the entry of a Schedule C business income or loss on a client's tax return. Now, I've pulled up a client's return and I've already entered the basic information. As you can see, I'm in the federal section. Here, I can click on the "Enter Myself" button or I can begin typing the word "schedule," which will pull up all of the schedules in the program. I'll click on "Go to Schedule C." This takes me to the Schedule C entry page. The Schedule C is made up of four sections. We've taken those and broken them up into their component parts just to make data entry a little easier. The business name, address, and business type are all on one screen to make it easier to complete. First, did the business have a business name? The name of our client's business is Law and Doctor. We'll give the business an Employer Identification Number and fill in the address. The zip code for the business will automatically fill in the city and state. One thing I'll mention here on this screen is that if your client's business did not include a DBA (Doing Business As), then the program will assume that the client's personal name and social security number will be in the header. Next is the business code. You can select the code from this comprehensive list or you can enter the type of business. For example, our client is a landscaper, and that will satisfy the IRS requirement as well. Click "Continue," and we're now at what we call the Schedule C main menu. This main menu covers basic information, questions about the operation of the...

Award-winning PDF software

Where to enter 1099-ltc in taxslayer Form: What You Should Know

For all Forms 1099-LTC (received with respect to the “Insured”) that have “Per Diem” checked in Box 3, enter the total of amounts listed in Box 1. Income>Less Common Income>Cancellations of Debt: 1099-C, Form 982 Income>Less Common Income>Cancellation of Debt: 1099-LTC, Form 8-LTC Long-Term If not taxable, do not enter, if taxable, then Out of Scope; Instructions for Form 1099-LTC, 1099-LTC Long-Term: 1099-LTC may be reported if the policyholder was in a policy and received less than 1,000 in gross wages during 2025 and paid taxes within 365 days of being issued the policy. If the policy is in an individual's name, income must exceed 1,000. If the policy was issued to a corporation, tax must exceed 1,000. If the policy was issued to a trust, tax must exceed 5,000. In 2016, no individual or corporate policy was issued. The amount of a policy in the employee's name cannot exceed 5,000. As a general rule, the amount of a policy owned by a spouse, who is also the holder of a qualified policy, is limited to no less than 100,000. For more information about tax reporting, go to IRS.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-LTC, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-LTC online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-LTC by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-LTC from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Where to enter 1099-ltc in taxslayer